#HelloFuture

Meet DGTL eKYC+

We built our eKYC platform from the ground up to support seamless, secure data transfer by any user remotely, while also ensuring an intuitive data management process that checks all the boxes for your institution.

Powering Banks, Credit Unions & Other FIs #dgtl

Built specifically to serve the financial institutions and their clients in every market globally

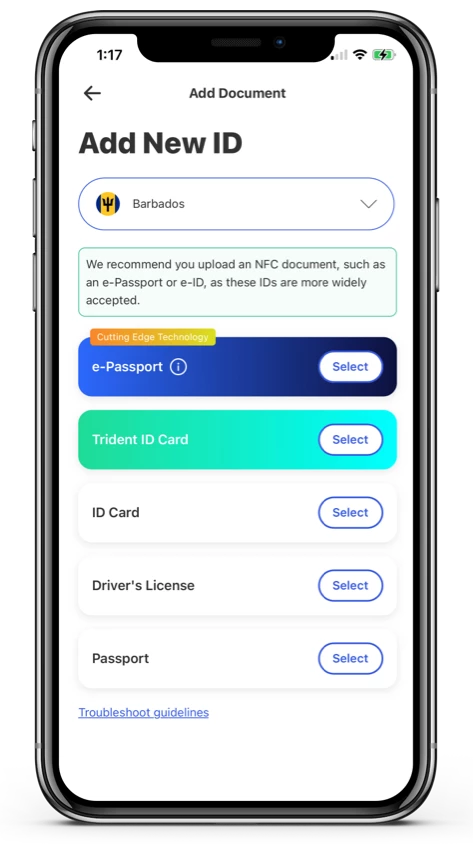

Go App or Appless

We offer app or app-less eKYC, enabling seamless identity verification via mobile app or web browser for maximum customer convenience.

Liveness Detection

Enhance KYC by verifying that customers are physically present during the identity verification process, preventing fraud and ensuring secure onboarding.

Risk & Sanctions

Enable automatic customer risk assessment through our AI Risk Engine or set manual risk ratings (high, medium, low). Check for sanctions, political status, and negative news, all within our platform.

Biometrics & OCR

Our eKYC process uses biometrics and OCR to accurately capture and verify customer ID details, such as passports, ensuring secure and efficient identity verification.

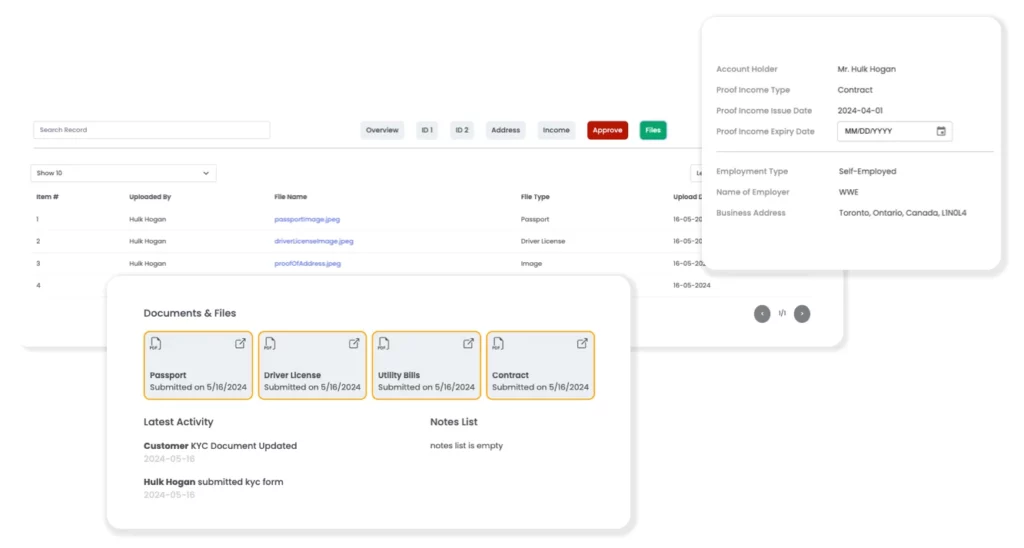

Data and Documents

Securely manage user, staff and KYC data whether you're using our SaaS version or an on-premise deployment

Analytics and Reporting

Generate reports by KYC status, P.E.P exposure, Country of Residence, Risk Rating and more.

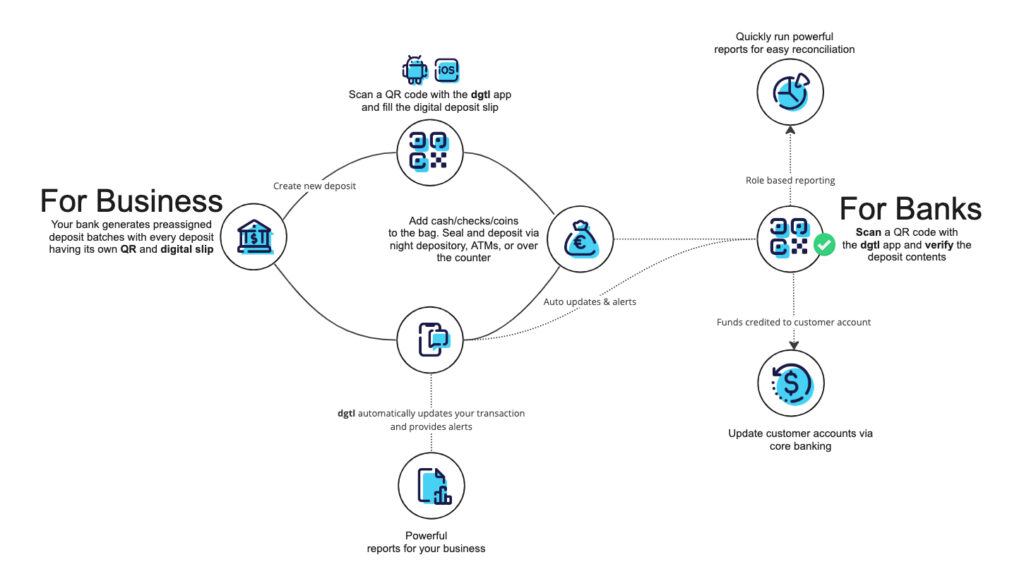

How it works

IIC Digital Deposits is a turnkey cash deposit and reporting platform built from the ground up to digitize, streamline and innovate cash deposit transactions. The platform supports everything from night bags (containing checks, cash, coins and foreign currency) to ATM deposits, to over the counter cash deposits made by businesses, entrepreneurs and other clients.

TAKE A TEST DRIVE

A.I, Risk, Liveness Detection, Biometrics, ID Verification and more.

Schedule a meeting with our team for a full demonstration of how it works.